We live in a time of some uncertainty. Perhaps no more or less uncertain than other times or seasons, but it is genuine and present for the Baby Boomer Generation. Politicians on both sides of the aisle are printing money with no end in sight. Meanwhile, 10,000 Boomers approach retirement every day. For many, the security they had in mind erodes as dollar value cheapens.

Real estate, experts say, is one asset that can face that devaluation because it is a “hard asset” and will ride the economic tide upward quite nicely. But real estate also has other issues that will often cause an aging property owner to want to sell, at least of real estate that requires their management or oversight. Let’s look at an example.

Marjorie Lundquist lives in the suburbs of a larger metropolitan city. At 71 years of age, she feels as though life is changing. She has owned a successful retail business nearly her entire adult life. It has given her a comfortable income and, in the early years, it provided a distraction from a painful divorce. But now, she is wondering how much longer she wants to continue. Lately, she has been comparing another day at the office to a beach or Disneyland trip with her granddaughter, and the office is taking a back seat. She may sell the business as well as the building that her business operates from. She has an employee interested in buying, but that transaction is still a couple of years away.

A more pressing issue is a small apartment building that she has owned for more than 20 years. The suburb she lives in has enjoyed real estate appreciation that exceeds national averages by quite a bit. She has a manager for the apartment, but it remains one of those 3 AM distractions and worries that she wants to get rid of. Also, the national economy seems uncertain in many ways, including possible changes in taxes on real estate.

Marjorie is secure financially. She could sell the building, pay the taxes and still “be ok,” but the idea of more than $1,000,000 in taxes just doesn’t sit well with her. Marjorie is not alone. There are many in her shoes.

Folks like Marjorie typically own the non-institutional portion of wealth held in real estate in 4 ways:

- Equity in their residence

- Equity in residential investment real estate

- Equity in commercial investment real estate

- Equity in real estate that is part of an operating business (car dealerships would be a good example)

The aging process motivates these Boomers to do something with their real estate, particularly their investment real estate, and several issues will come into play.

- The property has gotten older and needs a capital infusion to stay competitive. As people age, there is an increased aversion to borrowing more money, increasing their debt obligations. As people age, their greater desire is to eliminate debt rather than take on new debt.

- When they were younger, putting “sweat equity” into their real estate investment was a source of relaxation, pleasure, or fulfillment. As people age, this type of physical labor becomes unfeasible.

- There are significant responsibilities that come with being a landlord. Payment of property taxes, insurance, maintenance beyond “sweat equity,” and renovations all become burdens for the older landlord.

- Liability issues. Most landlords will maintain some kind of liability insurance, but if there is a personal injury on their property, they, as landlords, will often be drawn into a lawsuit.

- Being a landlord demands very complex responsibilities. As people age, the desire is to simplify life, and to be a landlord works against this desire for simplicity.

- The issue of risk takes on greater importance. Having all their real estate eggs in one basket creates a risk.

Perhaps the most significant hurdle to addressing these issues for the senior real estate investor is a tax liability. If they simply sell the real estate to eliminate the above issues, the Long Term Capital Gains taxes become a new issue they may not want to face

Seniors like Marjorie are more sensitive to their “legacy” than ever before in their lives. When they had young children or were in focused “career mode,” life seemed as though it would last forever. Giving to their favorite charity was viewed as a civic or religious duty. They were pleased to attend the next banquet or charity golf outing. They enjoyed the camaraderie and the sense of impact on their community.

Today, all of those things are still true. But a new motivation, a new awareness, has surfaced in their thinking and conversation. They now see that life will not last forever. They now have friends who are suddenly “gone.” And in those quiet moments, they ask themselves, “What has my life counted for? Have I made a difference? Will anyone remember me when I’m gone?”

These are thoughts that invade their sleep and linger during quiet moments. Sometimes they even come up during a conversation at the club or over lunch or a glass of wine. “What is my Legacy”?

At this point, you may be asking what on earth an aging rental property has to do with an aging property owner. “I’m focused on getting rid of this warehouse at the moment. I’m not concerned with who will remember me.”

Well, the two topics converge remarkably. Those taxes you may face when you sell your investment real estate are referred to by some as Involuntary Philanthropy. The state and federal government receive those tax dollars and say ‘thank you very much” and then go about spending them on everything from highways to other expenditures that you, quite frankly, would never choose. Involuntary Philanthropy has become such a part of our lives that too often, we simply comply blindly without asking, “Is there another way”?

The good news is, YES, THERE IS ANOTHER WAY.

What if you could reduce, defer or even eliminate those taxes on the sale of a property? What if you could sell the property, pay no taxes, enhance your retirement income, create predictable, secure, and passive income while at the same time creating a legacy? What if you could “disinherit” the government in favor of your favorite charities? YOU CAN!

Every situation is different, but let’s go back to our conversation about Marjorie as an example. She would like to sell her building but let’s look more closely. She would like to:

- Sell the property and harvest the high appreciation;

- Remove the management burdens so that she could spend more time with her one daughter and grandchildren;

- Reduce the long-term capital gains tax; and

- Enjoy some retirement income that did not involve dealing with tenants.

She also cares deeply about two charities in her community and does not want her support to diminish during her retirement years.

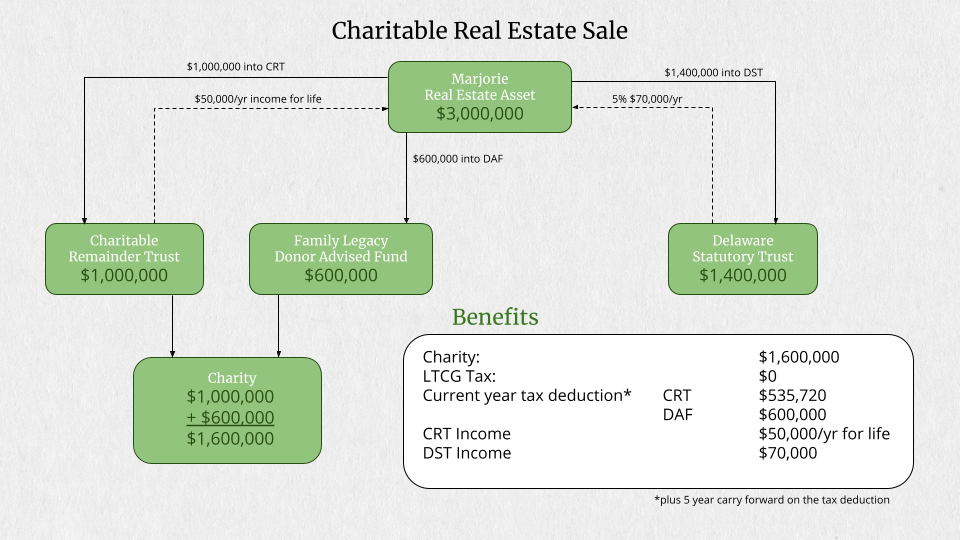

So, let’s help Marjorie; Reduce or eliminate taxes, provide for her daughter while fueling her legacy.

We call this our 3 Bucket Strategy:

Bucket 1. Transfer an undivided interest (say 40% of the property) into a Delaware Statutory Trust (DST)

The 1031 Like-Kind Exchange strategy is an effective way to address all of the above concerns. Her benefits include:

- 100% tax deferral to include:

- state capital gains

- federal capital gains

- depreciation recapture

- 3.8% Medicare tax

- Predictable net income based on the strength of the lease/leases.

- 100% passive investment. No landlord responsibilities for any aspect of the real estate. Professional management.

- Nonrecourse financing. The investor gets the benefit of leverage but on a non-recourse basis.

- Real estate ownership with the complexities of traditional ownership

- Ability to diversify, reducing the risk to real estate ownership

- Access to institutional-quality real estate, which also reduces risk

The DST allows her to have easy “mailbox” income while deferring the anticipated taxes completely. And it enables her to pass the DST on to her daughter in her estate. Under current law, the daughter would receive a stepped-up cost basis, and if she later wanted to sell the DST, she would have paid zero capital gains taxes, and for this lady, she would also pay zero estate taxes. We have moved $1,200,000 to the daughter completely tax-free.

Bucket 2. Transfer 50% undivided interest in the property into a Charitable Remainder Trust.

This tax-exempt trust has been a popular tool for selling appreciated assets since 1969. The CRT is an irrevocable trust through which the trustee distributes an annual income stream, typically to individual beneficiaries for the balance of their life. Upon the trust’s term expiration, the trust terminates, and the remaining trust assets are distributed to identified tax-exempt charities chosen by the donor.

The CRT allows the property owner to sell an undivided interest in her building, pay no taxes, and receive income from the trust for life. Also, the CRT creates a charitable income tax deduction that will reduce her taxes in the year of the gift and up to five additional years.

The CRT is an irrevocable trust, but there are some things you can change. You can change the trustee who serves as fiduciary of the trust. You can change the professional who manages the assets in the trust, and you can even change the charity you want to receive the funds at your death.

You will want to discuss and explore some other vital issues before implementing a CRT, and we are pleased to help you along with the professionals at Copenbarger Law Firm.

Bucket 3. Transfer a 10% undivided interest into a Donor Advised Fund.

This tax-exempt tool is the fastest-growing solution in the charity world for the past 30 years. Although it does not provide any income back to the property owner, it does allow her to sell that portion of the property tax-free, receive a Fair Market Deduction today, and then give out of that DAF over time.

My wife and I call our DAF, our Charitable Checking Account. There are three additional benefits to the DAF that we particularly enjoy.

- All of our giving to charity goes out of our DAF. We give to 14 different charities each month, but I have not written a check to a charity for years. The gifts go out automatically. No Fuss.

- Like you, we often get invited to some charity event by some friends. It’s a nice evening out, and we enjoy hearing about other charities. But we don’t want to add a new monthly commitment for our giving. We would rather give MORE to the charities we support than be a Mile Wide and an Inch Deep. So, we simply call up our DAF and ask them to cut a check to XYZ Charity and make us anonymous. This allows us to be generous that evening but not be added to another charity’s list of donors.

- Finally, in our estate plan, we are giving 25% of our estate to each of our three daughters and another 25% to charity. We call that final 25% A Child Named Charity. If we list those charities in our will or trust and then change our mind on a charity two years from now, we would otherwise have to call up our attorney and spend $750 to do an amendment or codicil. But if we give in our estate through our DAF, we simply call the DAF and ask them to change Charity A for Charity B. Easy.